Unlocking Private Capital for Business Growth

& Real Estate Investing

We specialize in connecting entrepreneurs and investors to exclusive, non-traditional funding opportunities designed to fuel growth and build wealth.

OUR SERVICES

Real Estate Investors & Developers

Unlock access to flexible capital solutions designed for your next project. Whether you’re acquiring, refinancing, or breaking ground on new construction, we connect you with alternative funding sources beyond traditional banks.

From private lenders to creative financing strategies, we help you structure deals that move faster, close smoother, and maximize returns. Discover a smarter way to fund your real estate vision.

Business Owners

Build, grow, and scale your business with strategic funding tailored to your goals. We help entrepreneurs strengthen business credit and access non-traditional financing options that aren’t advertised by banks.

Whether you need working capital, equipment financing, or expansion funds, we provide clear guidance and connections to lenders who understand your vision. Discover the multitude of opportunities available to fuel your business success.

Why Choose Us?

Differentiators:

* 25+ Years’ Expertise–Deep networks in private credit and institutional lending.

* Investor-Aligned Structuring– We protect capital while maximizing yield.

* Borrower Advocacy– Get lender-ready and negotiate better terms.

* Partnered with 20+ Private Lenders

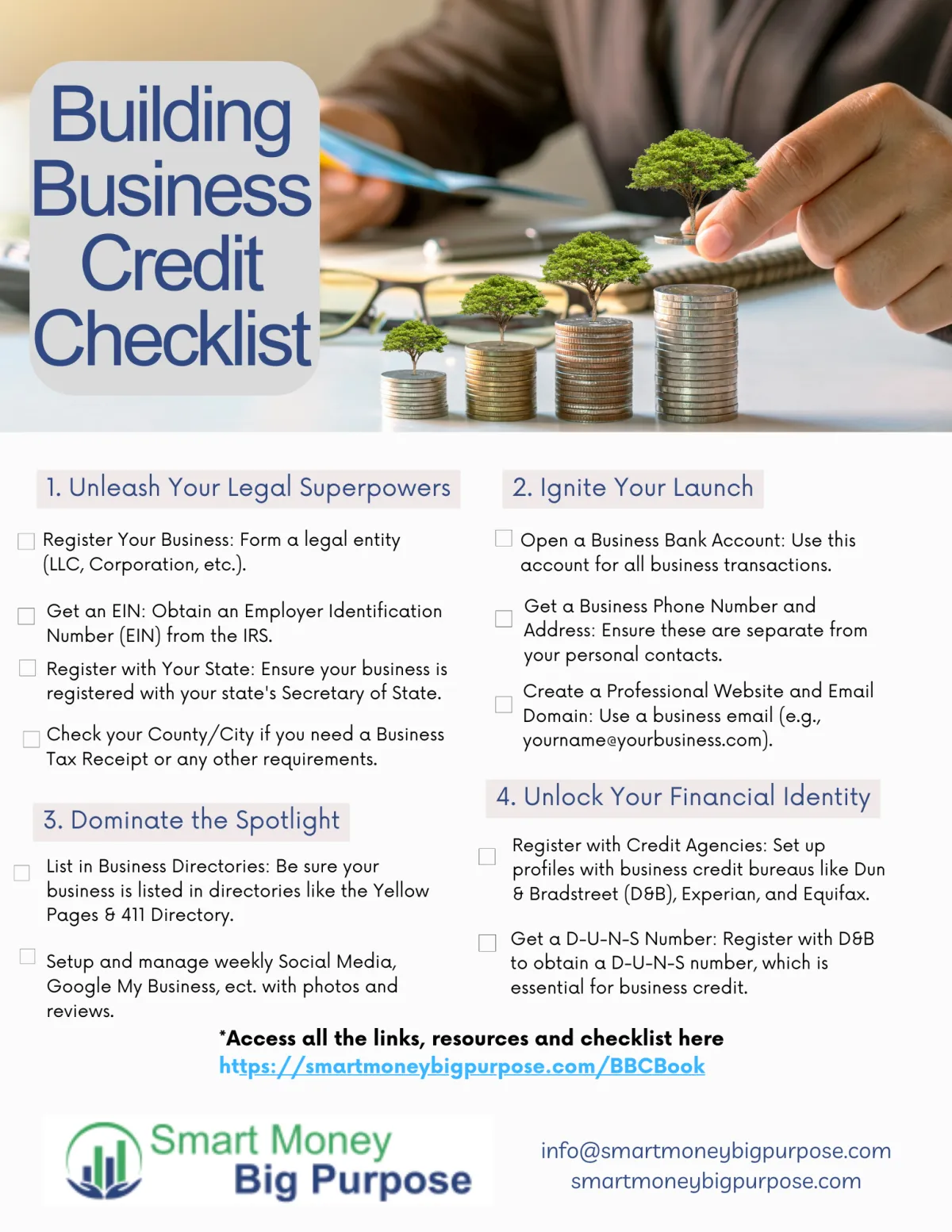

Building Business Credit Checklist

Building business credit is essential for securing financing, negotiating better terms with suppliers,

and ensuring your business’s financial health.